Cross-border real estate investment in the Asia Pacific region could achieve a record high this year as foreign investors shore up interest and seek assets in greener pastures beyond borders.

As it stands, year-to-date intra-regional cross-border transaction volumes have already exceeded the previous 10-year record high in 2015 (1Q15-3Q15) by 30 per cent, and is currently a 21.8 per cent step up from its 10-year average (2007-2016).

Singapore the main source of intra-regional capital

Chinese would be the largest group of foreign investors if inter-regional flows were part of the picture. But in the context of intra-regional capital flows (which only considers deployment within Asia Pacific), Singapore continues to dominate with year-to-date foreign investments currently standing at US$5.6 billion.

China (US$2.1 billion) and Hong Kong (US$2.9 billion) were ranked second and third respectively given a significant portion of capital are recycled between the two closely-integrated countries.

These three countries make up 85 per cent of total source of foreign capital within the region.

Singapore has been the dominant outbound purchaser for a long period now and the momentum will continue, as investors remain keen on increasing their exposure in emerging markets.

Office assets remain top picks for investors

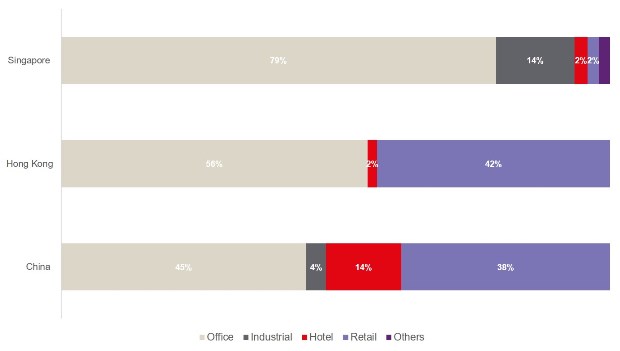

Much of the capital from these countries is allocated to office assets. From the standpoint of Singapore investors, most are seeking to plough capital in gateway cities such as Melbourne and Sydney, which offer steady and attractive income streams.

79 per cent of Singapore capital has been allocated into outbound office assets, with 11 out of 18 of the office assets acquired based in Australia. One such cross-border deal is the acquisition of 206 million Telstra Plaza building by Singapore’s ARA Asset Management and co-investment vehicle Straits Real Estate.

While 45 per cent of China capital is allocated to office assets, most are flowing into Hong Kong strata-titled opportunistic assets, with a focus on capital growth.

Figure 1: Allocation of intra-regional cross border capital outflow by asset class Source: JLL

Source: JLL

Australia and China most popular for foreign investors

Australia and China draw the most foreign investments given assets in those markets generally offer more attractive yields. But relative to domestic purchasers, (Figure 3) India stands out with 65 per cent of its total transactions coming from foreign investors (all of which were Singapore based institutional funds investors).

One notable example was Singapore sovereign wealth fund GIC’s US$1.4 billion joint venture with DLF Cyber City Developers, which also happened to be the largest cross border deal year-to-date.

These investors are looking to ride the investment wave via debt deals and joint ventures with local partners, as the market continues to grow in depth and demonstrates their willingness to shift from traditional markets if the opportunity presents itself.

For more insights on capital…