For FY 2018, direct commercial real estate investment volume for Asia Pacific totalled USD 160 billion, increasing from FY 2017’s figure of USD 149 billion.

Out of this growing allocation of capital to real estate, a clear preference for value-add investment strategies has emerged.

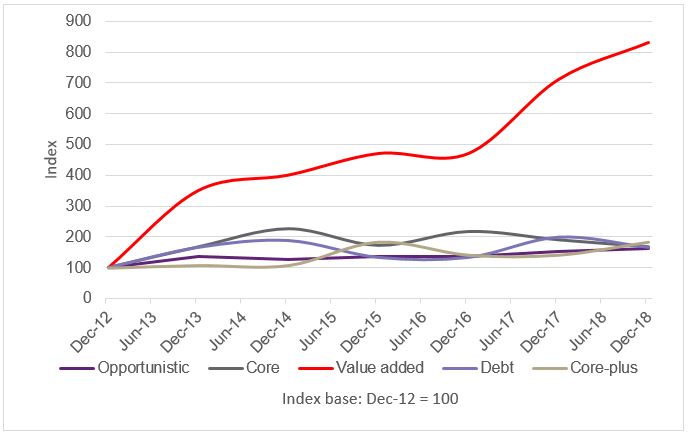

Figure 1 shows that core, core-plus and opportunistic strategies have remained relatively unchanged in terms of their dry powder over the six years ending December 2018.

Core and core-plus are characterised by lower risk and lower returns; generally Grade A office buildings in core locations of major cities, with diversified tenant mixes and stable occupancy rates.

Opportunistic, on the other hand, is higher risk and higher return, focusing on buildings that generally require significant enhancement or redevelopment.

Figure 1: Changes in dry powder by strategy

Source: Preqin, JLL

Value-add, however, characterised by medium-to-high risk in tandem with medium-to-high return, has been winning the popularity contest over the same period. Typical value-add categorisations would involve the purchase of an asset which is encountering operational issues or could benefit from refurbishment, then modifying and effectively repositioning and stabilising the property, before selling it at a favourable point in time with a higher valuation (usually holding for 4-10 years) to maximise return.

Lack of availability of core product

With a lack of availability of core product, investors are finding it increasingly difficult to deploy capital to core assets in central locations and are looking to source suitable product in more fringe locations.

In addition, existing owners of core assets are more reluctant to sell in the current market as re-entry and securing new assets is becoming increasingly challenging. These factors contribute to the increased interest from investors in value-add investments.

Yield compression

As capital value growth has outpaced rental growth in most Asia Pacific markets during the course of this cycle, core yields have compressed which may be another reason for investors moving up the risk curve to chase higher returns, in order to deliver their required returns. In tandem with the late cycle stage, investors may opt to take on more risk as “underpriced” assets are generally much harder to find.

Enhancing the value add

Proptech has broadened the scope for office building enhancement through changing the way real estate is managed and occupied. Integration of new technologies is helping to address occupier demands and transforming the human experience by optimising utilisation of space, employee productivity and wellbeing.

Sustainable refurbishment and associated building accreditations, such as LEED or WELL, provide further tangible proof of added value. These factors can boost rental income through increased occupancy and improved rental levels via improved tenant quality. Furthermore, certifications such as these tend to reduce occupancy costs and increase asset value…