E-commerce has been the most dynamic segment of the Internet economy in ASEAN over the past three years. The value of e-commerce rose four-fold, from $5.5 billion in 2015 to more than $23 billion in 2018.

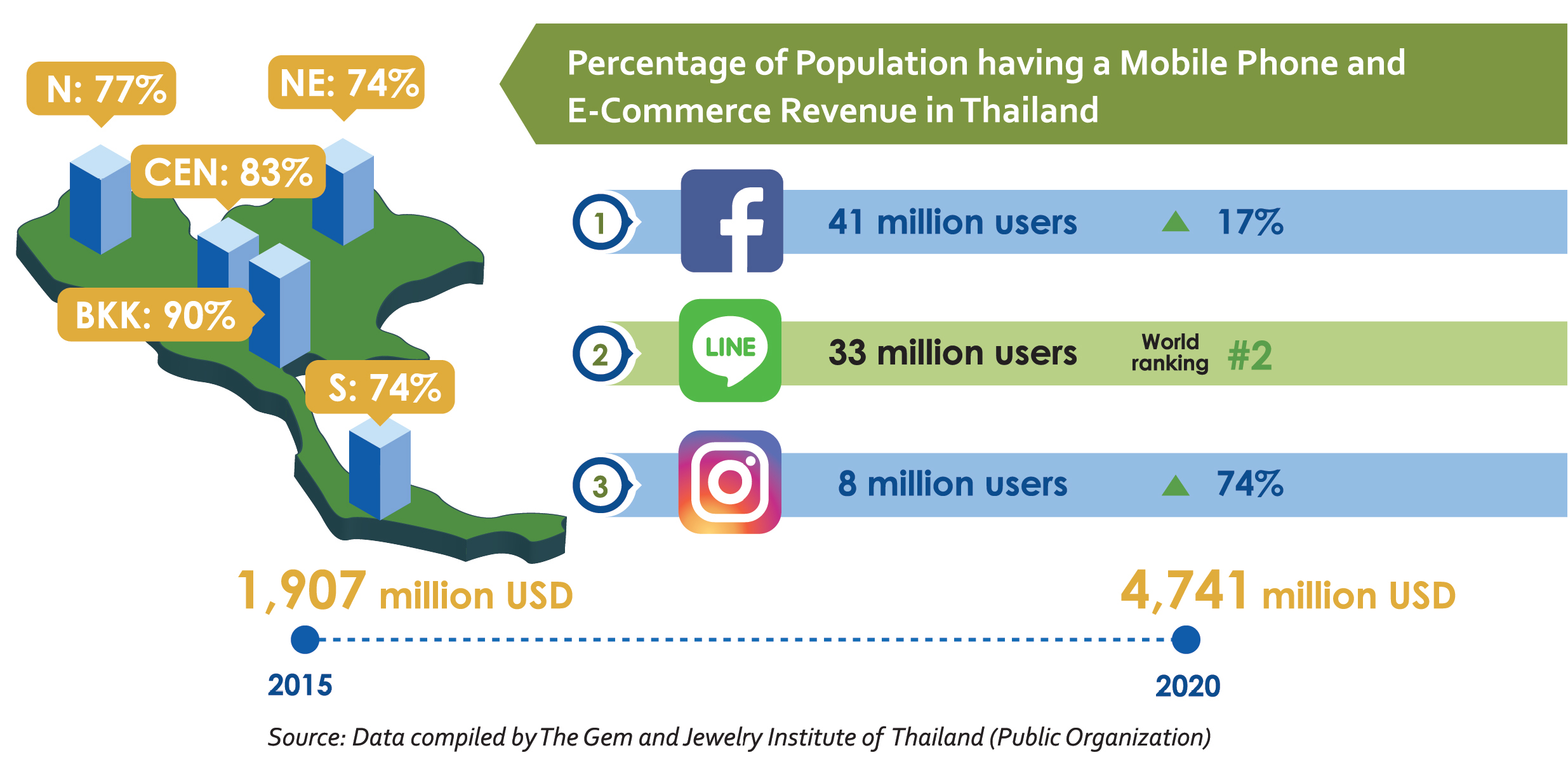

Indonesia accounted for the most ($12 billion), and Thailand and Vietnam each accounted for about $3 billion.

E-commerce transactions in the region are expected to exceed $100 billion by 2025. The affordability of mobile internet, greater consumer trust in e-commerce and the growth of the logistics industry to handle e-commerce deliveries have been among the main drivers of this rapid growth. Many online retail companies have expanded their presence in ASEAN.

In 2017, Amazon (United States) invested in Singapore to enter the region’s growing market, with a particular focus on Indonesia. DHL eCommerce (Germany) expanded in Thailand because of the high growth in e-commerce activities in that country.

In 2018, Alibaba (China) extended its e-commerce activities concurrently in Indonesia, Malaysia, the Philippines, Singapore and Thailand. Goxip (Hong Kong, China), a fashion e-commerce site, has been making further investments in Malaysia, after having established a presence there in 2016.

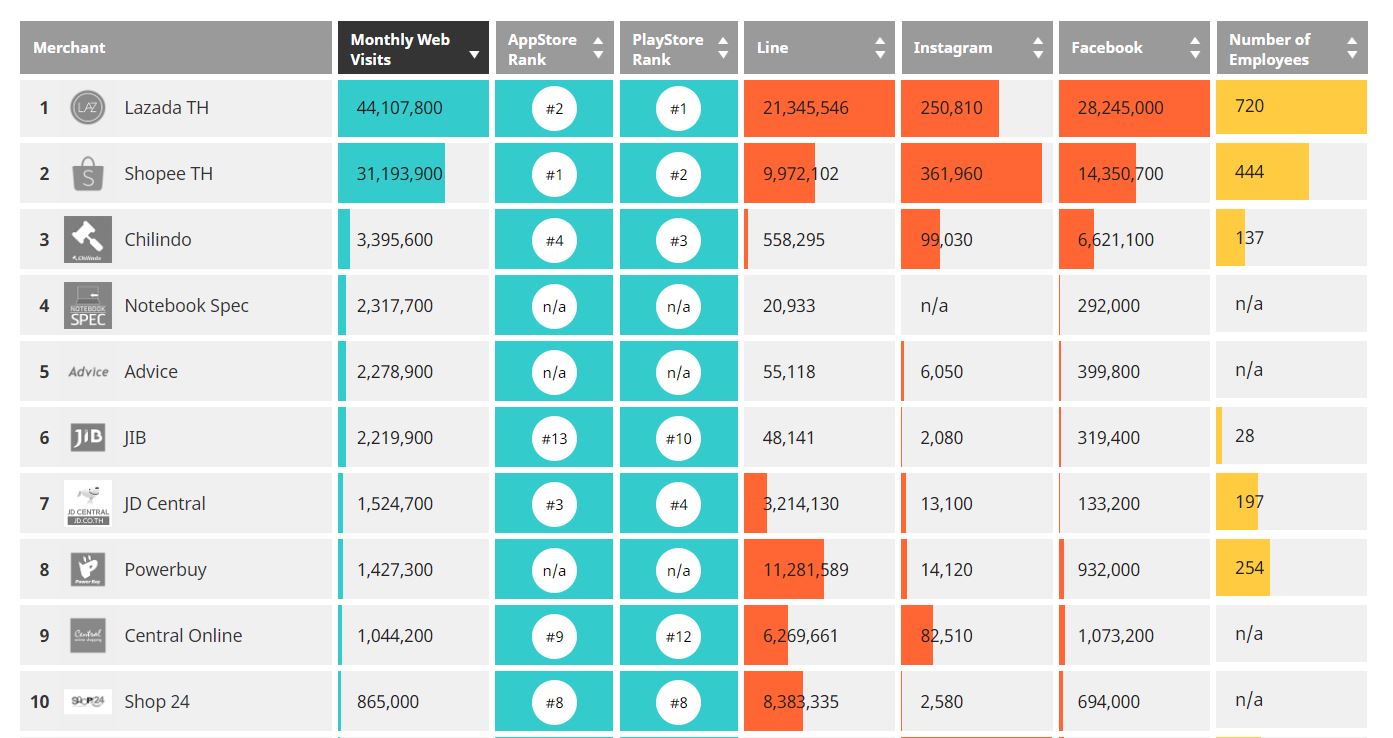

Online retailers such as Zalora (Singapore) have grown rapidly without needing physical retail stores. Traditional retailers have responded by selling through online retail platforms such as Lazada Marketplace and the Go-Food platform (Go-Jek (Indonesia)) to leverage their online presence and market reach, or by developing their own e-commerce platforms.

This new customer-centric focus has fostered a rapid increase in e-commerce sales in retailing. In ASEAN, e-commerce has been the most dynamic sector in the growing digital economy. The main shopping portals include Lazada (China) and Shopee (Thailand).

As in the banking and logistics industries, new kinds of start-ups have also emerged in the retail industry, using technology to venture into the e-commerce space.

The 50 most-funded e-commerce start-ups in ASEAN have raised $12.6 billion as of July 2019, with most of the funding raised in the last two years. Many of them raised those funds to scale up operations and to expand into other ASEAN Member States.

The thriving e-commerce start-up environment is attracting many venture capital firms and corporate investors. In 2018, JD (China) led a Series C investment round in the Vietnam e-commerce company Tiki. In September 2017, the company and Central Group (Thailand) formed a $500 million e-commerce joint venture.

Other venture capital firms based in ASEAN, the United States, Europe and other Asian economies have been actively providing funding that supports the growth of the region’s e-commerce market place (AIR 2018). Start-ups such as Tokopedia (Indonesia) have benefited from such support.

Source : Asean Invesment Report 2019

About the author

Li Zhong is a tech journalist who covers the latest developments in artificial intelligence, robotics, and biotechnology. Li is passionate about exploring the ethical and social implications of emerging technologies.