On October 5th, twelve Pacific rim countries signed the Trans Pacific Partnership (TPP) by which they agreed upon the establishment of the largest free trade area, encompassing 40% of the global economy.

Members of the partnership are Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States and Vietnam.

The TPP primarily aims to boost sustainable growth, create jobs, foster inclusive development and promote innovation across the Asia Pacific region but also to push China to adjust its stance in commerce, investment and business regulation to TPP-standards.

The deal still requires ratification by lawmakers in the TPP countries before entering into effect.

Content of the TPP agreement

The agreement comes along with significant market openings from Canada, the United States and Japan by reducing or eliminating tariffs on almost 18,000 categories of goods, particularly in respect of farm products such as sugar, rice, cheese and beef.

It also contains guidelines for dispute resolution between foreign investors and governments, the request to governments not to discriminate foreign investors and the demand to specific countries to improve their labour standards. In addition, the agreement addresses new facets of data trade and data storage, intellectual property rights and finance, which have yet been subject to other multilateral trade deals, as well as non-traditional issues such as climate change, collective bargaining rights and music piracy.

Impacts on Thailand disputed

Since Thailand has not yet joined the partnership, it is disputed whether the agreement will have negative impact on Thailand’s competitiveness and if the country therefore should join the TPP.

Some experts fear significant losses in the export sector, especially in relation with the US-market as one of Thailand’s major export destinations (10% of the total). The food industry might be affected negatively under the agreement.

For rice, in particular, Japan agreed to reduce tariffs and non-tariff barriers on food imports and establishes a quota of 50,000 tonnes of US imports rising to 70,000 tonnes over 13 years. This may concern food exports, given the fact that Thailand is one of the world’s leading exporters of rice.

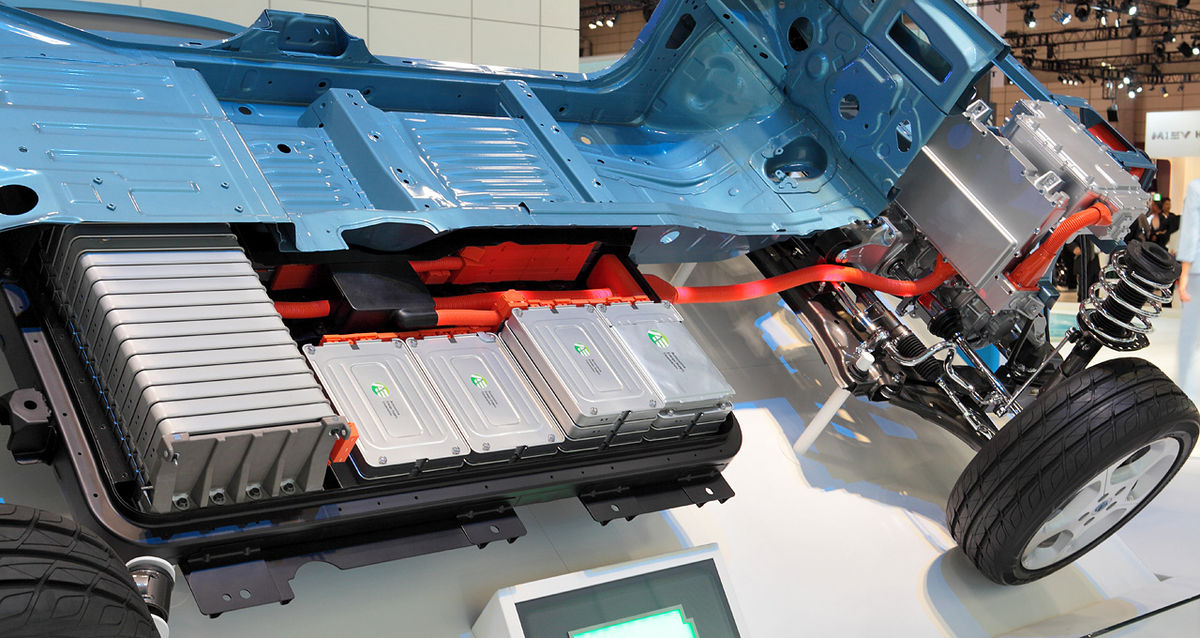

As a negative side effect, a shortfall in exports could also lead to a relocation of factories for affected products from Thailand to TPP-member states in the region due to tax and rules of origin benefits among the partnership.In contrast, no serious negative effects are expected to occur in the Thai automotive export sector as a result of significant investments by Japanese automakers in the past.

Under the agreement, the United States have made concessions to lower its tariffs on Japanese car parts from non-TPP locations like Thailand and China. Hence, the Thai automotive export may even benefit from Japanese manufacturers. However, Japanese car makers at the same time are urging Thailand to join the TPP and in this context refer to direct privileges for the Thai automotive sector such as the rules of origin-issue for cars under the TPP.

Foreign investments are also predicted to decrease after implementation of the agreement, considering that TPP-members in the Asean-region will catch up due to enhanced trade conditions.

According to an analysis of TMB bank, this especially applies to Malaysia and Vietnam. Thailand still remains ahead in attracting foreign investors, although the winning margin decreases continuously.

In 2005, foreign investments coming into Thailand were over four times those going into Vietnam and almost twice as much compared to Malaysia. By 2014, the ratio has dropped to 1.3 times against Vietnam and was negligible higher against Malaysia. Considering the TPP-agreement, experts predict that Vietnam and Malaysia will overtake Thailand in foreign investments within the first years after implementation.

According to Banjarong Suwankiri, chief economist of TMB Bank, Thailand’s competitiveness might suffer under the agreement in the low-cost and labour-intensive industries against Vietnam and on the supply chains or more sophisticated industries against Malaysia. Next to that, Thailand’s attractiveness for foreign investors has suffered during the past years due to political instability….

Read the complete article on: Trans Pacific Partnership (TPP) and its implications on Thailand | Rödl & Partner