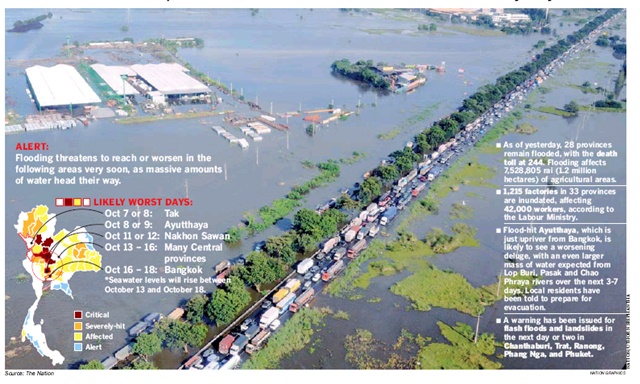

The ever-increasing risk of natural disasters continues to impact global underinsurance rates, particularly in Asia, according to new research from Lloyd’s, the world’s specialist insurance and reinsurance market, and the Centre for Economics and Business Research (CEBR).

In Lloyd’s Underinsurance Report 2018, underinsurance continues to represent a significant threat to global economic development with an estimated US$163bn of assets underinsured in the world today.

- Lloyd’s Underinsurance Report 2018 reveals US$163bn insurance gap globally – a decrease by 3% from US$168bn in 2012

- Insurance gap for Asian countries has increased by 9.4% to US$134bn since 2012

- China has the largest insurance gap (US$76bn) due to the size of its economy and its developing insurance market

- Bangladesh, Indonesia, Philippines, Vietnam and India among countries with the lowest levels of insurance, yet most exposed to risk from natural disasters

The underinsurance gap for Asian countries has widened by 9.4% to US$134bn

In 2012, the first edition of the global report revealed US$168bn in underinsured assets globally. While the global gap has closed by almost 3% over the last six years, the gap for Asian countries included in the report has widened by 9.4% to US$134bn from US$122.5bn.

At the same time, the world has seen a series of extreme weather-related catastrophes and new risks such as cyber attacks have emerged, posing additional threats to society.

“It is concerning that while the global insurance gap is closing, in Asia it is widening at a rapid rate owing to the increasing threat of natural disasters and the region’s economic growth.

Lloyd’s Acting Chief Executive Officer Asia Pacific, Iain Ferguson

Countries with more wealth stand to lose more in pure financial terms. China is the country with the highest insurance gap (US$76bn) of the 43 countries covered in the report, which is largely due to the size of its economy and the fact that the insurance market is still developing.

98% of losses resulting from natural catastrophes in China between 2004 – 2017 were not covered by any type of insurance.

Of the 43 countries studied, 18 were found to have insurance gaps, with 9 of these countries based in Asia.

The countries with the highest levels of insurance penetration (total insurance premiums as a percentage of GDP) in Asia are South Korea at 5.0%, Hong Kong 3.4% and Taiwan 3.4%.

Several countries in Asia are singled out in the report as being among the most exposed to risks such as climate change and are countries least able to fund recovery efforts. These include Bangladesh, India, Vietnam, Philippines and Indonesia, each with an insurance penetration rate of less than 1%.

The country with the highest expected annual loss from natural disasters, Bangladesh, also has the largest insurance gap relative to GDP (2.1%). Expressed in absolute dollar values this equates to an insurance gap of almost US$6bn in Bangladesh. The second highest is Indonesia at 1.4% of GDP, equivalent to an insurance gap of US$15bn.

Underinsurance in a growing cyber security market

Lloyd’s Underinsurance Report 2018 also examines the emerging threat of cyber attacks, which is estimated to cost businesses as much as US$450 billion a year globally1.

Despite the loss of data, revenue and reputation from a cyber attack being potentially as destructive as any natural disaster, this was an area with a high level of underinsurance, with levels of cyber insurance engagement varying dramatically globally.

The cyber security market in the US is the most mature, primarily because 46 out of 50 of the US states have mandatory requirements for data breach notification which can be extremely costly.

Despite the rapid growth in digitisation across Asia Pacific, governments have been slow in implementing similar types of laws and countries in the region still lack notification clauses for data breaches, with the exception of Australia, Japan, South Korea and the Philippines.

Lloyd’s Acting Chief Executive Officer Asia Pacific, Iain Ferguson, said:

“It is concerning that while the global insurance gap is closing, in Asia it is widening at a rapid rate owing to the increasing threat of natural disasters and the region’s economic growth.

“Developing countries are affected disproportionately by natural disasters and their losses are often compounded by poorly designed and constructed infrastructure, inadequate maintenance, a lack of insurance and delayed recovery.

Insurance is a major contributor to disaster recovery, often providing the quickest financial crisis relief available. Insurance pay-outs frequently happen in days or weeks whereas humanitarian aid for reconstruction can take months to reach disaster zones.

“The insurance sector, in partnership with governments in the region, must act now to help tackle this crippling underinsurance crisis that threatens global prosperity.

We need to work together to help people understand the insurance products that are available and to provide improved access to these products, so we can give people in the world’s most exposed economies the security they desperately need.”

The impact of disasters can be reduced by investing in greater resilience. A range of studies suggest that, on average, the benefits of resilience (broadly defined) outweigh the costs fourfold (see UNISDR (2007), OECD (2015) and UK Government Office for Science (2012).

The Centre for Global Disaster Protection today published a new report, produced in conjunction with Lloyd’s, Risk Management Solutions (RMS) and Vivid Economics, detailing four potential new financial instruments that could be used to incentivise investment in resilience.

The report also underlines the important role that risk financing can play by providing liquidity after a disaster, protecting government balance sheets and buffering taxpayers. The Indonesian government, for example, is reportedly looking at disaster risk financing, with support from global reinsurers, following the recent devastating Sulawesi quake and tsunami.

About the author

Siam News Network includes top references news sites, Job Board, Business Directory and Classifieds Portal