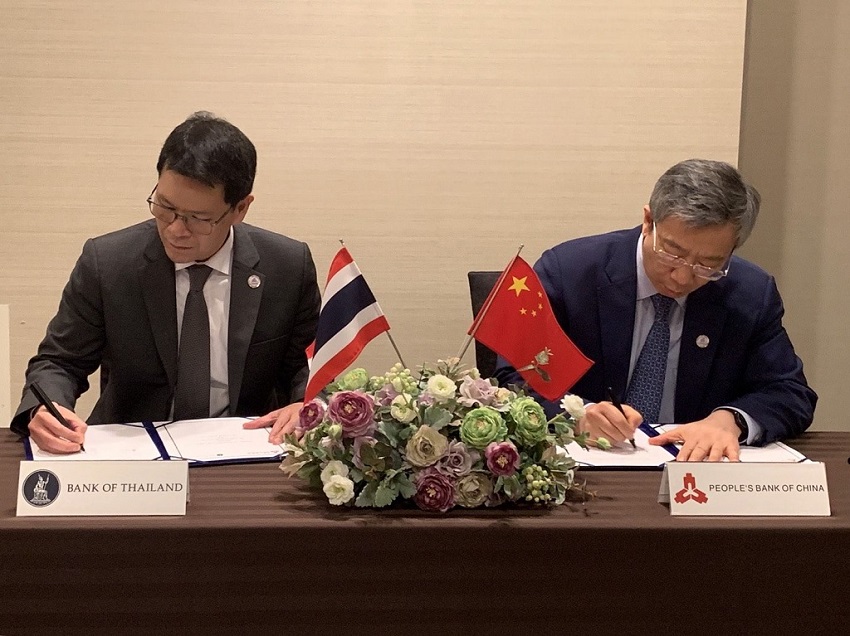

On 9 June 2019 Mr. Veerathai Santiprabhob Governor of the Bank of Thailand (BOT) and Mr. Yi Gang Governor of the People’s Bank of China (PBC), signed a Fintech Co-operation Agreement in Fukuoka, Japan.

According to this agreement, the BOT and the PBC will collaborate on several issues, including:

(1) joint innovation projects and research,

(2) information sharing and

(3) regulatory coordination.

The BOT and the PBC share a common interest to create fintech-friendly ecosystems that support the advancement of innovations and technologies.

The two central banks aim to promote the use of innovation and technology to reduce costs and improve efficiency of financial products and services.

Source : Bank of Thailand

About the author

Akanksha Singh is an Indian journalist based in the bustling city of Bangkok, Thailand. With a degree in Mass Communication and years of experience, she has become a trusted voice in reporting on Southeast Asian affairs.