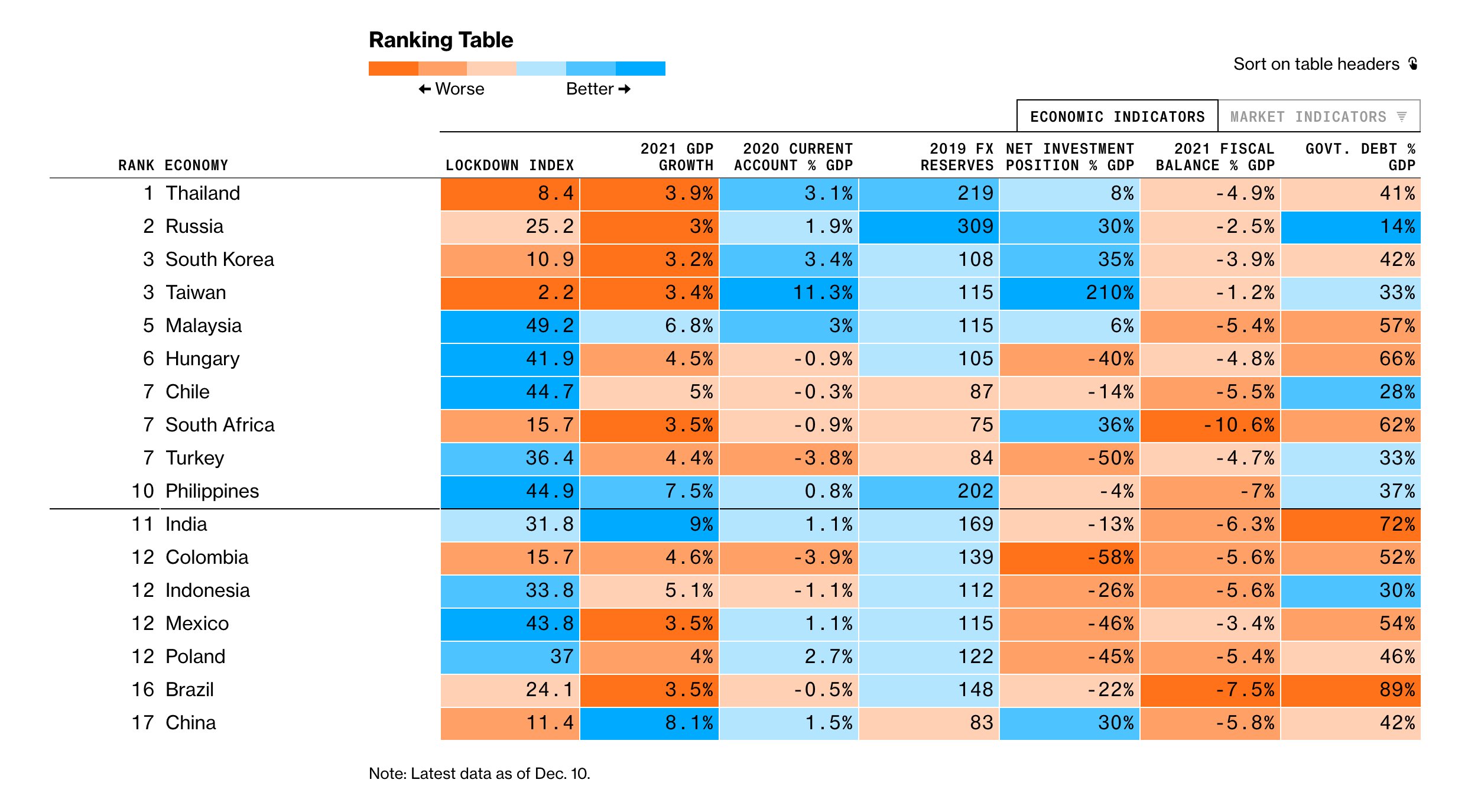

Thailand and Russia are well placed to be among the emerging-market standouts that could beat expectations next year, according to a Bloomberg study of 17 developing markets gauging their outlook for 2021.

Thailand topped the list, owing to its solid reserves and high potential for portfolio inflows, while Russia scored No. 2 thanks to robust external accounts and a strong fiscal profile, in addition to an undervalued ruble.

The Government Spokesman Anucha Burapachaisri reported today that Prime Minister and Minister of Defence Gen Prayut Chan-o-cha has welcomed the ranking of Thailand as the number one country on Bloomberg’s Top Emerging Markets list, indicating high potential for Thailand’s economic recovery thanks to the government’s economic stimuli and investment promotion measures.

The U.S. media firm has conducted studies on the 2021 outlook in 17 emerging markets, covering Thailand, Russia, China, South Korea, Malaysia, and Indonesia, and based on 11 indicators of economic and financial performance.

Among these markets, Thailand received the top ranking thanks to the country’s reserves and potential for portfolio inflows.

There remains a worry, especially among poorer less-developed countries, that they’ll be left behind in global vaccination distribution, and emerging markets have certainly taken their share of hits to Covid-era growth, including those like Thailand that are especially dependent on tourism.

That said, Bloomberg surveys show that analysts are penciling in high rates of growth next year for some of those that have been hardest-hit in 2020.

About the author

Boris Sullivan is a business news editor based in Hong Kong. He has over 15 years of experience in covering the latest trends and developments in the Asian markets, as well as the global economy.