The 2019 novel coronavirus outbreak is expected to have a short-term but serious impact on the Chinese economy.

Since major cities have been shut down and disconnected from one another, local consumption will take a major hit. But Hong Kong’s SARS experience in 2003 demonstrates that while the impact of an epidemic on an economy is likely to be severe, it can also be short-lived.

While Hong Kong’s GDP did not drop much during the SARS period, the labour market slackened significantly, causing the unemployment rate to rise as high as 8.7 per cent. These observations create two key areas of concern for China: the length of the impact of the novel coronavirus outbreak and the severity of the resulting economic consequences.

The first concern is difficult to address without knowing when the viral outbreak will ease. The novel coronavirus bears remarkable resemblance to seasonal influenza and SARS in terms of its transmission through respiratory droplets.

China’s flu season commences in December, with the number of infections peaking in January and February before tapering off.

Recent research from Hong Kong University shows that the SARS virus was better able to retain its viability under lower temperatures and humidity, potentially explaining why the SARS outbreak ended in the summer of 2003.

SARS outbreak only offers limited insight about what is likely to happen in China

If the 2019 novel coronavirus shares the same seasonal pattern as seasonal influenza and SARS then infection cases may fall sharply in April when warmer weather arrives in China.

As to the extent that the current epidemic will affect China’s unemployment rate and GDP, China’s sheer geographical size compared to Hong Kong’s means that Hong Kong’s experience during the SARS outbreak only offers limited insight about what is likely to happen in China.

Every single sector in Hong Kong was affected by the SARS epidemic. But in China, it is likely that some sectors will be less susceptible to the current viral outbreak.

Most large companies in China are state-owned enterprises that don’t lay off workers in response to short-run fluctuations in the economy. Instead, retrenching workers generally only occurs when these enterprises are undergoing structural reform.

Unemployment is more likely to rise among small and medium-sized enterprises in sectors vulnerable to epidemics, such as catering, tourism and retail.

Exports in January and February this year may not be significantly different compared to the same months last year, as most production orders were received before the viral outbreak occurred. The epidemic will likely have a delayed impact on the export sector in March and April. Meanwhile, bad and non-performing loans are expected to increase, but the banking sector as a whole is unlikely to be heavily affected.

China’s GDP may drop to 5.5 per cent in Q1 2020

In the worst-case scenario, China’s GDP may drop to about 5.5 per cent in the first quarter of 2020. It is likely to hover at a similar level in the second quarter before eventually bouncing back to 6 per cent in the third quarter.

The Chinese central bank may further cut the reserve requirement ratio by 1 per cent to boost the economy. An interest rate cut is also likely. A generous stimulus package should be prepared for when the outbreak eases too.

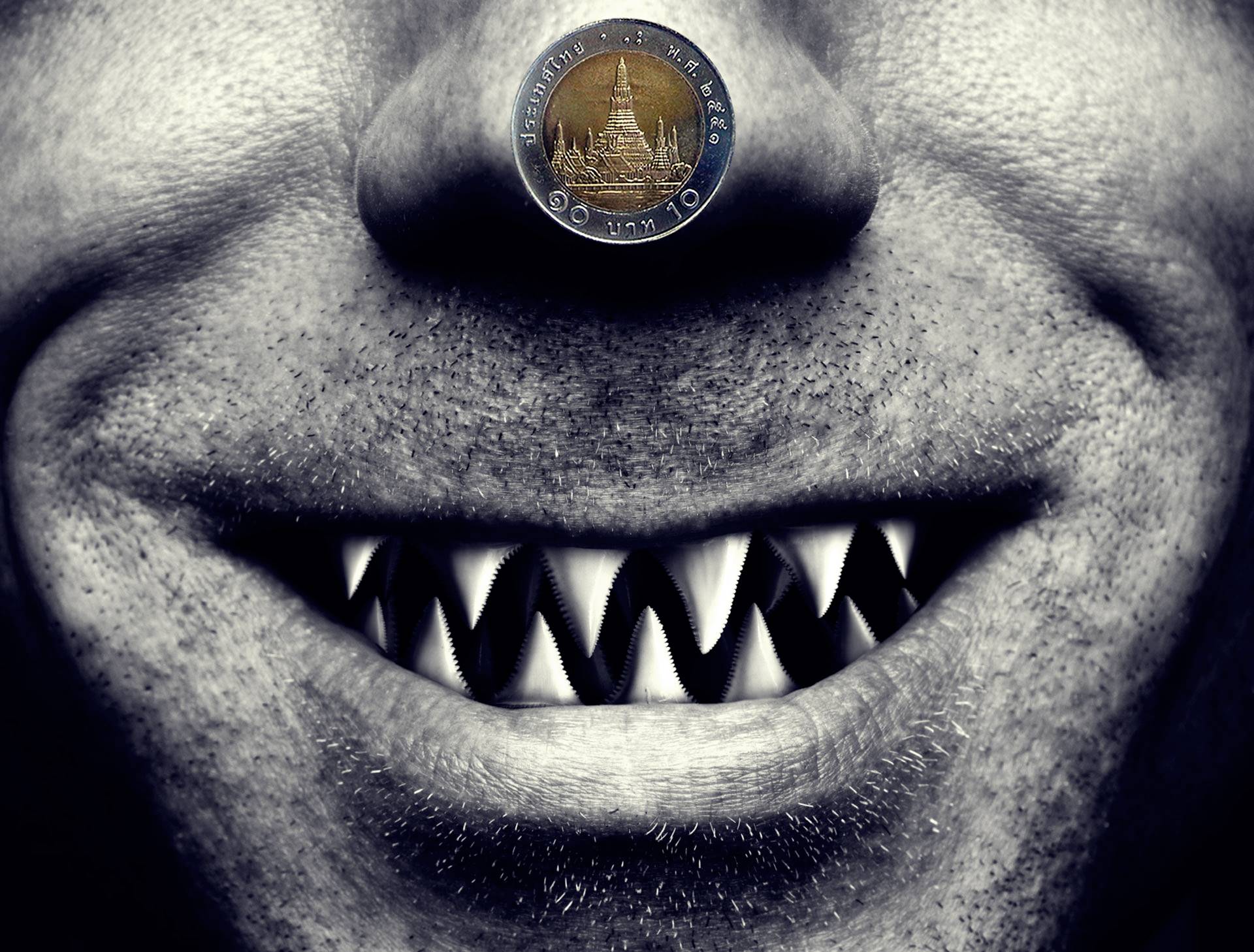

The economic impact of the epidemic is not restricted to China. Countries that rely heavily on Chinese tourists and exports, such as Thailand which receives about one million Chinese tourists monthly, will be affected. As inbound tourism from China grinds to a halt, East Asian and even European countries will soon feel the economic burden.

The suspension of production lines in China will also affect South Korea and Taiwan, where most intermediate product parts for Chinese goods are imported from. Shortages of Chinese manufactured and agricultural products in the world market will also lead to inflation in many countries.

The economic damage stemming from public panic surrounding the novel coronavirus is likely to be more severe than the actual damage done by the virus. The death rate per identified case is about 2 per cent — much lower than that of SARS in 2003. Those that are most at risk of death are the elderly and those with pre-existing conditions or weak immune systems.

Once we learn more about the virus, contain the outbreak, and have a vaccine ready, all will return to normal. We should keep faith in the medical service of the modern world and try our very best not to panic.

Terence Tai-Leung Chong is Associate Professor of Economics at the Department of Economics, The Chinese University of Hong Kong (CUHK).

About the author

East Asia Forum (EAF) is a platform dedicated to publishing accessible analysis on Asia, from Asia. EAF articles feature policy analysis and comment on politics, economics, business, law, security, international relations and society.