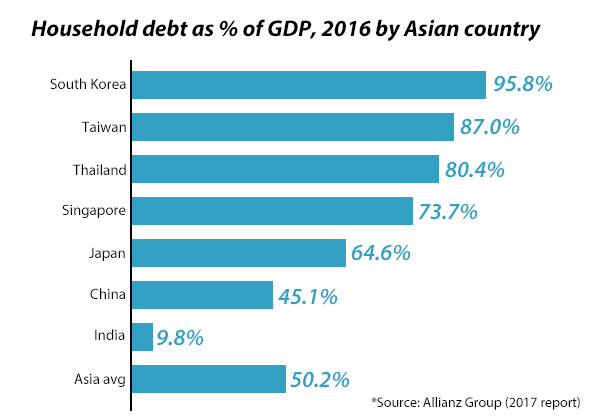

The so called “Chinese debt trap” has drawn a lot of commenting in the media, but Thailand’s biggest debt trap is still home-grown and has reached the value of 78.6% of the GDP, the third highest in Asian countries.

A study by the Bank of Thailand (BOT) has found that overall Thai household debt is still high.

Thai workers’ debt has surged to the highest in 11 years, driven by higher living costs and easier access to loans.

The latest survey by the University of the Thai Chamber of Commerce (UTCC) had 1,200 respondents whose income is 15,000 baht per month or less. It found 95% of them were in debt.

86% of respondents have no savings,

The survey estimated average debt per household at 158,855 baht, the highest level in 11 years, up by almost 15% from 2018.

Some 86% of respondents have no savings, mostly because of higher debt resulting in increased expenses, rising product prices, and higher housing and car loans reports the Bangkok Post

Mrs. Soamrasat Chantharat, Head of Research Group, Puey Ungphakorn Economic Research Institute, BOT, disclosed today that the study of Thai household debt using the credit bureau’s information on loan arrangements for the nine years from 2009-2018, showed that the proportion of household debt owed to large commercial banks and state-owned specialized financial institutions, had continually declined, in contrast to the increase in the growth of debt owed to medium-sized commercial banks and non-financial institutional service providers or nonbanks.

Most loan applications were submitted by existing borrowers

Only one-fifth of loans were granted to new borrowers. Most of them were car loans, home loans, motorcycle loans and personal loans.

Existing borrowers were found to have increased the amounts of new loans, with multiple accounts with many financial institutions, especially unsecured loans which often have a deteriorated credit quality.

With the number growing constantly, together with a concentration of debts and some types of non-performing loans in the market which is highly competitive, such as housing loans and personal loans in Bangkok and its vicinity and large city areas.

80.3% of respondents have defaulted on their debt repayment

Thanavath Phonvichai, vice-president for research at the UTCC, said most workers are concerned about the domestic economic slowdown and their overall sentiment remained weak despite the general election.

“Some 80.3% of respondents have defaulted on their debt repayment in the previous 12 months because they spent more than they earned. They want the daily minimum wage to increase on par with rising costs for utilities, travel expenses and food prices.”

Thanavath Phonvichai, vice-president for research at the UTCC

A study found that Thai household debt had an apparent faster growth rate than the country’s economic growth in 2018, with the household debt ratio at 78.6 percent, which is among the top three countries with the highest household debt in Asia.

Household debt picked up again to 78.6% of GDP at the end of 2018 from 78.3% in the previous year. Thais debt load peaked in 2015 at 81.2%.

This directly affects overall economic expansion.

The government sector works continually to resolve the household debt problem by promoting financial knowledge, issuing measures to regulate credit card and personal loans under the supervision of the BOT, and establish debt relief clinics for people to study and truly understand the major causes of debt from spending more money than they earn, especially non-essential spending, purchasing goods beyond their financial level, and a lack of an appropriate long-term financial plan.

About the author

Bangkok Correspondent for Siam News Network. Editor at Thailand Business News