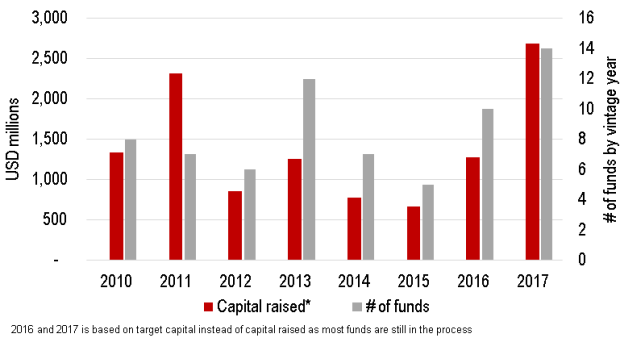

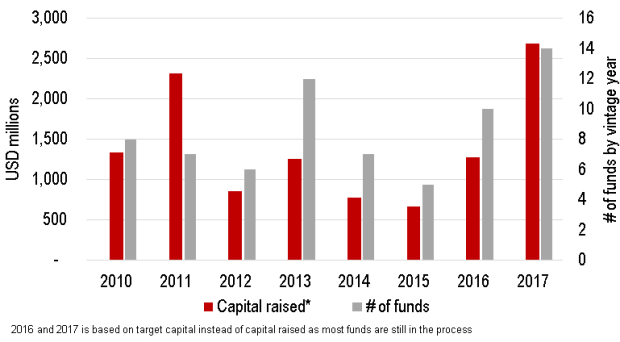

Private equity real estate debt funds in Asia Pacific are aiming to achieve a record volume of capital raised in 2017, with more funds actively in the market than any other year on record.

Funds whose primary strategy is debt investment are aiming to raise over US$2.5 billion in 2017, across 14 separate managers – more than double the target for 2016 vintage funds. In addition to this, there are a further 11 funds in the market targeting nearly US$10 billion that have debt strategies listed as a potential investment alongside other equity-based strategies.

Figure 1: PERE debt capital raising 2010-2017

Source: Preqin, JLL

Source: Preqin, JLL

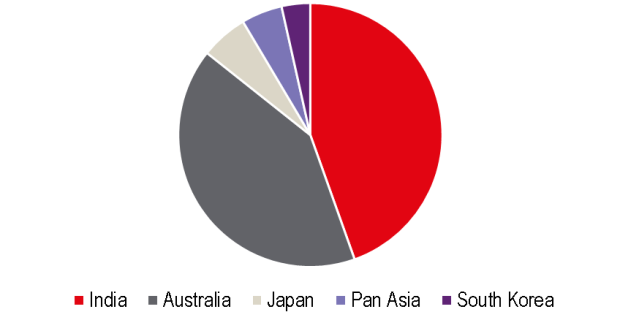

Much of the focus from these primary debt funds is on India and Australia, with funds targeting those markets accounting for 86 per cent of capital raised or targeted between 2015-2017 (YTD). Most fund managers are domestically-based and are raising capital in local currency, however some of the larger India funds raise in USD.

Figure 2: Market Focus: Debt funds raised 2015-2017

Source: Preqin, JLL

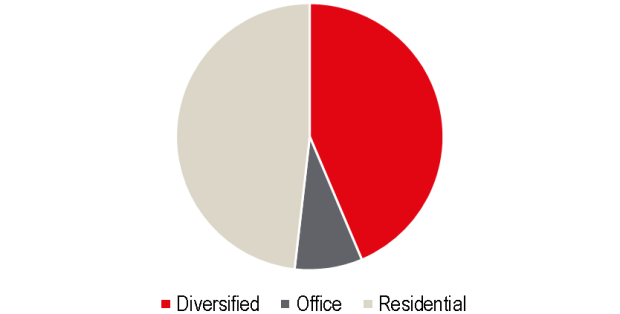

There is limited presence of Asia-wide or core debt funds in the market as almost all of these managers are targeting very specific investment strategies. Much of the capital is being allocated towards residential development projects of more opportunistic style mezzanine finance. Stated IRR targets generally range between 10-22 per cent, so we have yet to see any presence of those looking to provide senior debt pieces.

Figure 3: Target strategy: Funds raised 2015 -2017

Source: Preqin, JLL

Source: Preqin, JLL

Over the medium term, we expect to see a growing presence of real estate debt funds in Asia Pacific as traditional lenders shift away from riskier lending strategies. There are also more investors starting to enter the debt space as this cycle matures and returns between debt and equity start to converge.