Skyscanner data on searches and exits for users within the Chinese region reveals substantial growth.

This is reflected in industry data which forecasts high growth rates (around 8.4% between 2017 and 2022); and forecasts expect China to become the world’s largest source of outbound tourism by 2022, with 128 million trips. China is already the largest source of tourism expenditure and this is anticipated to grow by a further 10.9% between 2017 and 2022.

The core drivers of this growth in travel and expenditure are the emergence of a more affluent middle class, increased connectivity and the easing of travel restrictions.

China’s per capita disposable income was up 8.8% in H1 of 2017, and forecasts expect that 400 million of China’s urban consumers will fall into the category of middle-class by 2020. Combining this with their appetite for outbound travel makes it clear that there are strong opportunities for future growth in China’s travel market.

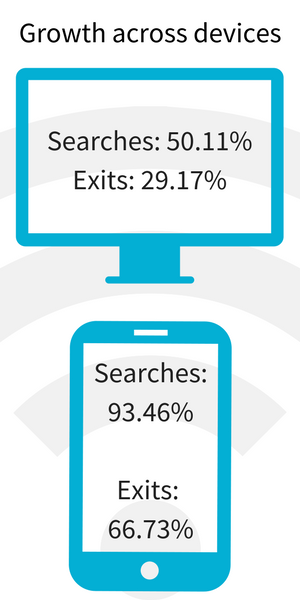

The industry trend towards mobile is also confirmed by our search and exit data, which reveals growth rates on mobile nearly double those on desktop. Clearly, businesses looking to engage with this audience need to take a mobile-oriented approach, which delivers on the expectations set by the m-commerce leaders of today (is content rich, offers a seamless payment solution etc.).

“People, after they buy a house, buy a car, the rest of the money, they would like to use to explore the world. Secondly, with the income level that’s increasing, visa restrictions by many countries are being lifted so we’re free to go [to] many countries.

— Jane Sun, CEO, Ctrip

Adapting to technology preferences

Whilst the China travel market offers great potential, Chinese travellers have unique needs, particularly when it comes to technology. In this market, mobile search, branded storefronts and seamless payment solutions are the norm in e-commerce.

“China is an authentically mobile society, and in the travel context, companies there have successfully used technology to automate payments and customer service within native mobile applications.

— Steven Pang, China General Manager, Skyscanner

To successfully acquire Chinese users, an authentically mobile approach is needed; with purchases no more than a few quick taps away. A handful of airlines, including KLM and Finnair, have begun to shape their approach through the integration of WeChat. However, more is needed to offer a truly localised product that reflects user preferences.

At Skyscanner, we are constantly working to adapt our offering and achieve product-market fit. In the Chinese market, this has meant introducing unique features such as our ‘inspirational feed’ on the Tianxun app. Knowing that many Chinese travellers only have between 5 and 10 days off each year inspired us to provide our users with ideas on how they could spend their limited time within their budget.

We are also working to offer a retail model more in-line with the needs of Chinese consumers through Direct Booking. We expect the inviting ambience and content rich interface of the solution to improve usability and performance – especially on mobile.

It is an approach familiar for Chinese consumers and has proven effective for Alibaba’s Tmall, which is actively used by 97% of Chinese online shoppers. It combines advanced search capabilities with content that makes it easy to assess and decide between options, whilst also giving each brand the opportunity to distinguish themselves on the platform. Additionally, the efficiency and simplicity of the Direct Booking shopping experience serves to add value – particularly in a market such as China, where seamless purchasing is so vital.

Interested in the Chinese travel market? It’s time to adapt — Skyscanner