The Stock Exchange of Thailand (SET) Index at the end of June showed an increase of 6.8 per cent over the previous month, making the best performer in Asia.

The Set is up 10.6 per cent from the end of 2018 to 1,730.34 points and SCB Securities thinks the Thai stock market may now rise to 1,750 points.

The combined market capitalisation of SET and mai at end-June jumped by 10.9 per cent from end-2018 to Bt18 trillion, moving in tandem with the SET Index

Foreign investors were the net buyers of Thai shares for the third straight month in June, gaining the highest monthly net inflows in the region.

The average daily trading value of SET and Market for Alternative Investment (mai) in June was Bt60.53 billion (approximately US$1.95 billion), up 3.1 per cent from the preceding month.

This has benefited the Thai stock market which may now rise to 1,750 points.

The trade war between China and the United States is in the process of negotiation and there is no indication that the United States will raise import tariffs on China imports, another 300 billion US dollars.

Mr. Sukit Udomsirikun, Managing Director of the Research Division, SCB Securities, said today the Thai stock market in the third quarter is in its best situation this year.

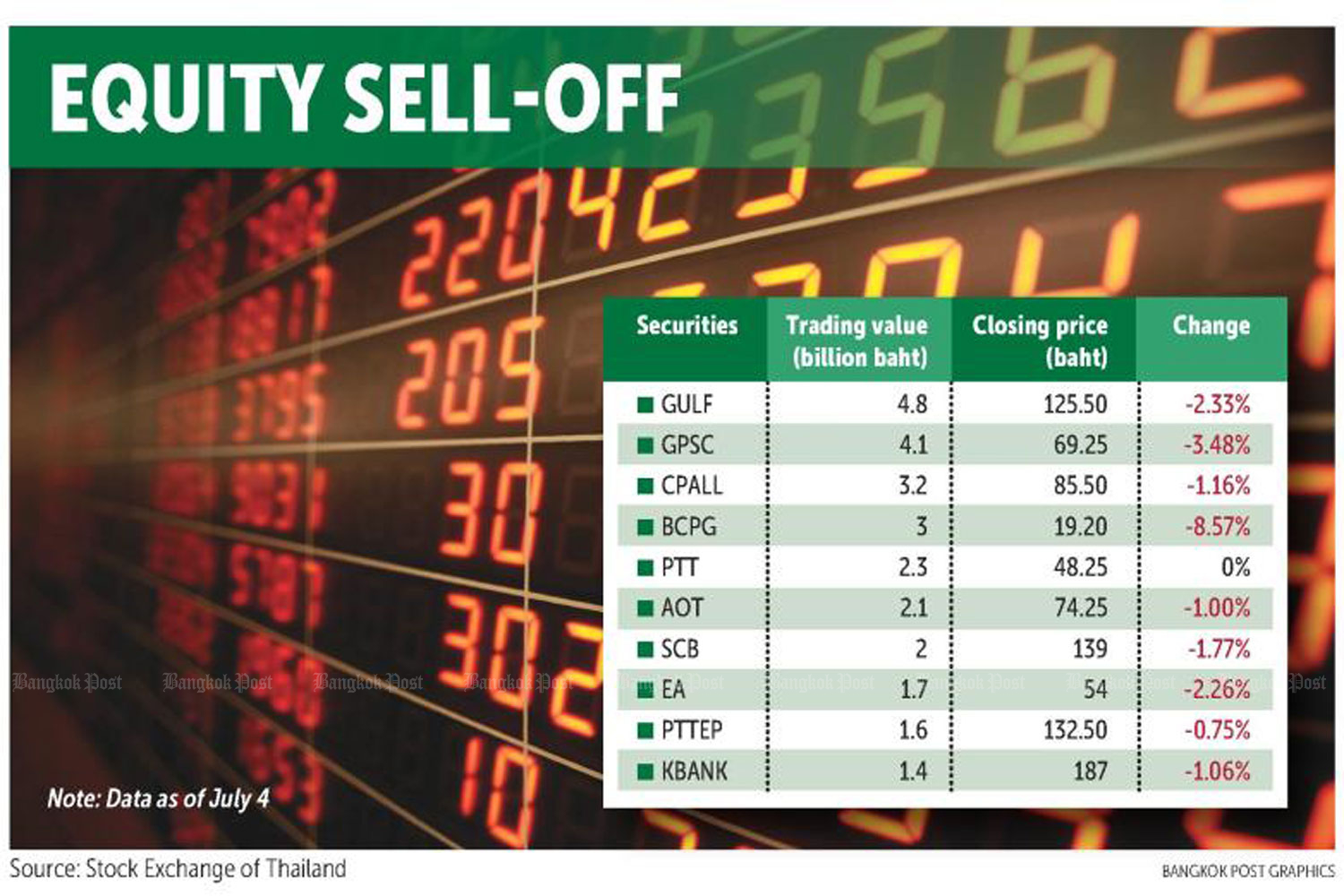

The index has an opportunity to reach 1,750 points, which is the target forecast by the Siam Commercial Bank (SCB). However, investors must beware of profit-taking because the Thai stock index has risen a lot. as shown today in the Bangkok Post graphic below.

Forward and historical P/E ratios of SET were 16.4 times and 18.6 times respectively at end-June, compared with the average of the Asian peers of 14.5 and 16 times respectively.

Dividend yield ratio of SET was 2.98 per cent at the mid-year point, above Asian stock markets’ average ratio of 2.79 per cent.

Trade war uncertainties remain

It is also necessary to follow the Federal Reserve’s meeting and developments in the trade war between the United States and China.

The SCB has expressed its belief that the Federal Reserve will not reduce the interest rate at its meeting in July after seeing that the United States is not raising import tariffs on China at this stage.

It is expected that the SCB will continue to follow the overall situation of the United States’ economy to see how much it is adversely affected by the trade war, while there is a chance that the interest rate will be further reduced in September 2019.

About the author

Bangkok Correspondent for Siam News Network. Editor at Thailand Business News