According to a press release issued by UOB, TMRW aims to make banking simpler, more transparent and more engaging for its customers through the use of data.

Asean Millennials banking

Dr Dennis Khoo, Head of Group Retail Digital, UOB, said that TMRW was created from scratch with the sole purpose of meeting the financial needs of ASEAN millennials.

Thailand’s digital generation will be the first consumers in ASEAN to experience TMRW, a digital bank powered by United Overseas Bank (UOB). TMRW is the first mobileonly bank designed for ASEAN millennials who prefer to bank on their mobile phones, anywhere and at any time.

“While ASEAN is known for its diversity, there remains a set of fundamental expectations by the digital generation when it comes to digital services, such as simplicity and an engaging user experience. So we took the time needed to understand our millennial customers and how and why they engage with mobile apps and digital services the way they do. We then used those insights in designing TMRW for today’s millennials. TMRW pushes simplicity to the limit and engages them in new ways beyond the standard digital banking functionalities

Dr Dennis Khoo, Head of Group Retail Digital, UOB

For example, in speaking with millennial consumers, UOB found that while they appreciate relevant guidance to help them keep track of and manage their finances better, they respond better to prompts that are fun and do not make them feel guilty.

According to a Moody’s analysis UOB chose Thailand to launch the bank because of the country’s relatively high and increasing mobile penetration and Thai consumers’ high level of engagement with social media.

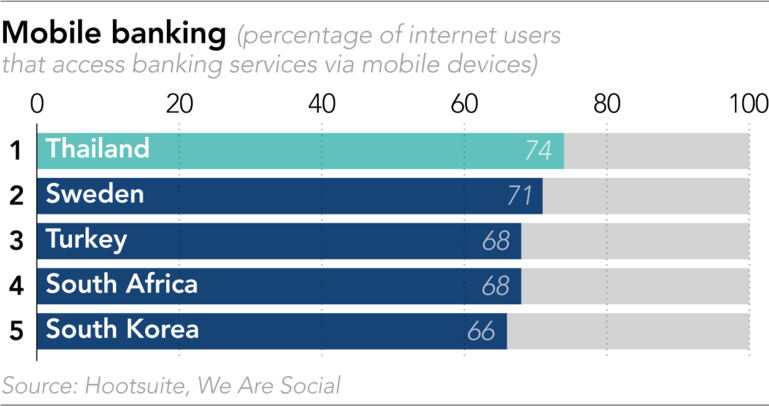

Among Thailand’s Internet users, 74% access banking services via mobile devices, according to the annual Global Digital Report 2019 from social media management platform Hootsuite and digital marketing agency We Are Social.

That puts one of Asia’s favorite vacation spots well ahead of the global rate of 41% and higher than China, at 61%.

Money management game

One of TMRW’s most popular features among the 1,500 customers who joined the pilot programme in Thailand is a money management game to help customers meet their savings goals in fun-sized, achievable steps. TMRW’s language is also free from banking jargon and is easy to understand.

TMRW aims to build a customer base of three to five million in the next five years and will contribute to UOB’s strategy to scale up its customer franchise across Southeast Asia. The Bank will launch TMRW in its next ASEAN market in the coming months

The digital bank can also help increase the presence of UOBT in Thailand’s retail segment, which is currently constrained by its relatively limited presence in the country. UOBT had a deposit market share of around 2% as of 30 September 2018.

Alka Anbarasu, Vice-President – Senior Credit Officer, Moody’s Investors Service

United Overseas Bank’s launch of digital bank in Thailand is credit positive

According to Moody’s latest press relaease, UOB’s push towards digital banking is credit positive because it will help the bank meet evolving customer expectations as the penetration of digital channels increases in Southeast Asia.

It will also help it prepare for the competitive threat from the digital transformation of other large Southeast Asian banks. TMRW will be extended to other Southeast Asian countries in the coming months.

On 14 February, United Overseas Bank Limited (UOB, Aa1/Aa1 stable) announced that it will launch a digital bank in Thailand, TMRW (pronounced “tomorrow”), that will be powered by artificial intelligence (AI).

About the author

Bangkok Correspondent for Siam News Network. Editor at Thailand Business News